Navigating Service Risks with Bagley Risk Management

Wiki Article

Just How Livestock Risk Protection (LRP) Insurance Policy Can Safeguard Your Animals Investment

Livestock Danger Security (LRP) insurance policy stands as a trusted shield against the unpredictable nature of the market, using a calculated strategy to safeguarding your assets. By delving right into the intricacies of LRP insurance and its multifaceted benefits, livestock producers can fortify their financial investments with a layer of safety and security that transcends market changes.

Comprehending Animals Danger Protection (LRP) Insurance Policy

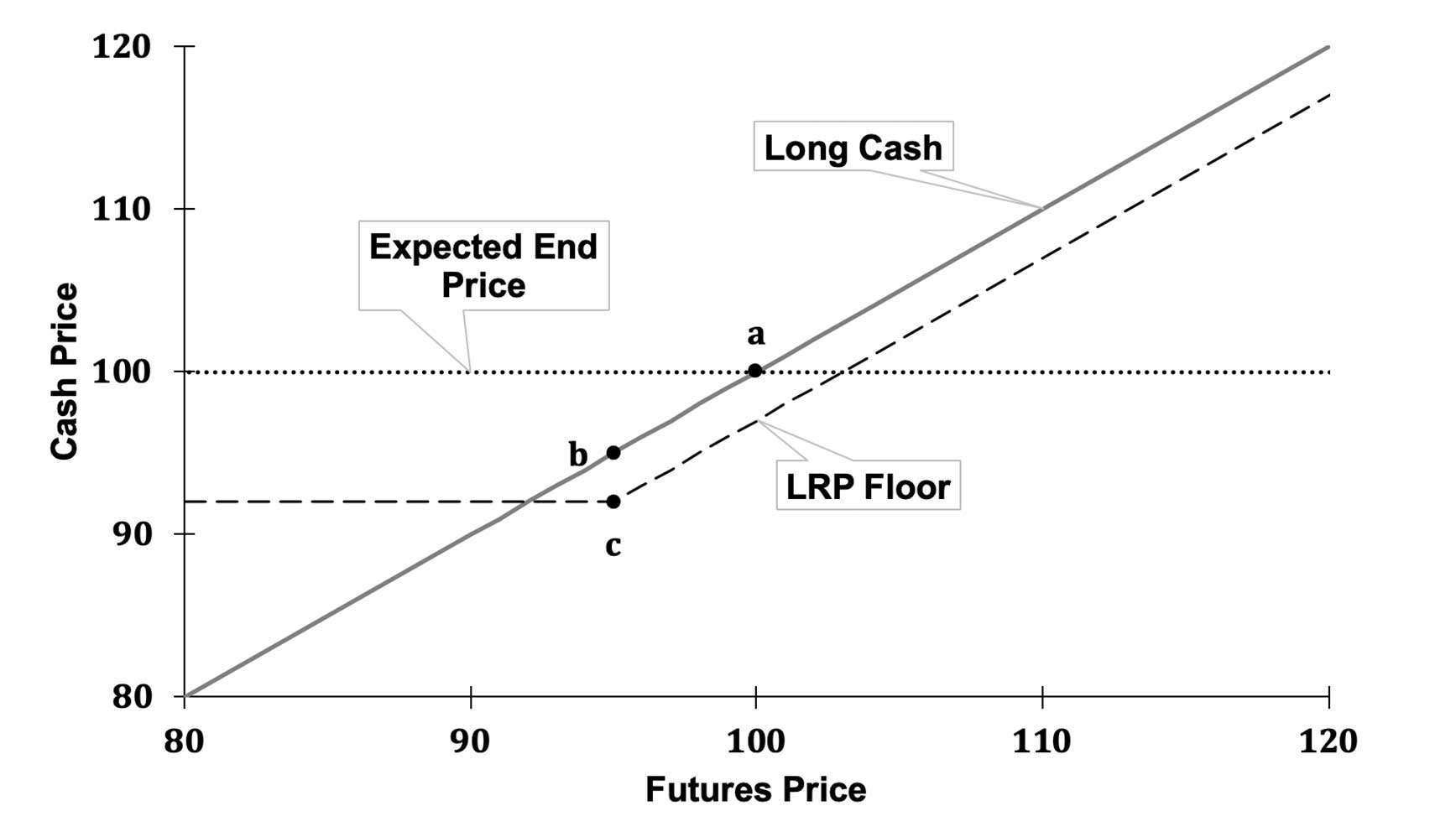

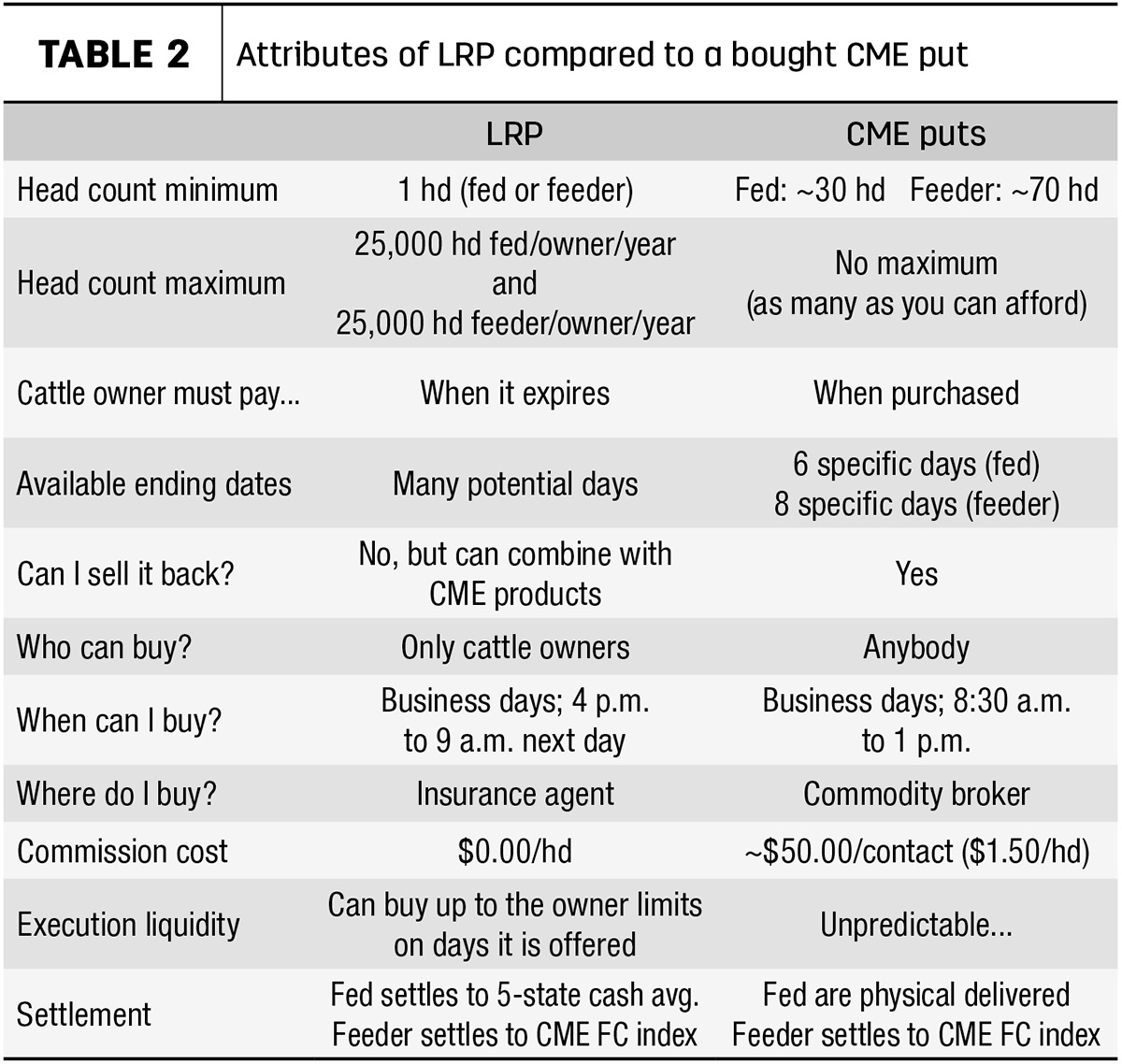

Comprehending Livestock Threat Security (LRP) Insurance coverage is important for animals manufacturers seeking to alleviate financial risks connected with rate changes. LRP is a federally subsidized insurance item made to protect manufacturers versus a decline in market rates. By giving insurance coverage for market price decreases, LRP assists manufacturers secure in a floor price for their animals, making sure a minimal degree of earnings no matter market fluctuations.One trick element of LRP is its flexibility, permitting manufacturers to customize coverage degrees and policy sizes to match their details needs. Manufacturers can select the variety of head, weight variety, protection cost, and coverage duration that straighten with their production objectives and run the risk of tolerance. Comprehending these personalized choices is important for manufacturers to effectively manage their rate threat exposure.

Additionally, LRP is readily available for various livestock kinds, including cattle, swine, and lamb, making it a functional risk management tool for livestock producers throughout various fields. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make educated choices to guard their investments and ensure monetary stability when faced with market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Livestock Danger Security (LRP) Insurance policy acquire a calculated advantage in shielding their investments from price volatility and protecting a secure economic ground amidst market unpredictabilities. One essential advantage of LRP Insurance is cost protection. By setting a flooring on the cost of their animals, manufacturers can mitigate the risk of significant financial losses in the event of market slumps. This permits them to intend their budgets much more properly and make informed choices concerning their procedures without the continuous fear of cost changes.

Additionally, LRP Insurance offers manufacturers with assurance. Understanding that their financial investments are protected versus unanticipated market changes enables manufacturers to focus on other aspects of their business, such as enhancing pet health and welfare or enhancing manufacturing procedures. This comfort can lead to boosted performance and success in the future, as producers can run with even more confidence and stability. On the whole, the benefits of LRP Insurance policy for livestock manufacturers are substantial, using an important tool for taking care of threat and making certain economic safety and security in an unpredictable market setting.

Exactly How LRP Insurance Policy Mitigates Market Threats

Mitigating market threats, Animals Danger Protection (LRP) Insurance gives animals producers with a dependable shield versus cost volatility and financial unpredictabilities. By using security against unanticipated cost decreases, LRP Insurance coverage aids manufacturers safeguard their financial investments and maintain economic security in the face of market see here now changes. This kind of insurance allows animals manufacturers to lock in a price for their pets at the beginning of the plan duration, making sure a minimum cost degree no matter market adjustments.

Actions to Protect Your Animals Financial Investment With LRP

In the world of agricultural risk monitoring, carrying out Animals Risk Security (LRP) Insurance includes a tactical procedure to protect financial investments versus market fluctuations and uncertainties. To safeguard your livestock financial investment efficiently with LRP, the initial step is to assess the specific risks your procedure faces, such as price volatility or unexpected climate occasions. Next, it is essential to study and choose a reputable insurance supplier that offers LRP go to this site policies tailored to your livestock and service requirements.Long-Term Financial Protection With LRP Insurance Policy

Ensuring withstanding economic security through the utilization of Livestock Threat Defense (LRP) Insurance coverage is a prudent long-lasting strategy for agricultural producers. By integrating LRP Insurance policy right into their risk monitoring strategies, farmers can safeguard their livestock investments versus unanticipated market variations go to my blog and adverse events that could endanger their financial well-being with time.One trick advantage of LRP Insurance for long-term economic protection is the comfort it supplies. With a dependable insurance plan in place, farmers can minimize the financial risks connected with volatile market problems and unexpected losses as a result of aspects such as condition outbreaks or all-natural calamities - Bagley Risk Management. This security allows manufacturers to concentrate on the everyday operations of their animals company without consistent concern about possible financial obstacles

Additionally, LRP Insurance coverage supplies a structured technique to managing danger over the long term. By setting details protection degrees and choosing proper endorsement periods, farmers can customize their insurance prepares to straighten with their monetary objectives and run the risk of resistance, guaranteeing a protected and lasting future for their livestock procedures. Finally, buying LRP Insurance coverage is a positive technique for agricultural producers to attain enduring economic safety and security and protect their resources.

Conclusion

In final thought, Animals Threat Security (LRP) Insurance coverage is a useful device for animals manufacturers to minimize market threats and safeguard their financial investments. It is a sensible selection for guarding animals financial investments.

Report this wiki page